There are generally two types of Trust Receipts that are commonly used in international trade transactions:

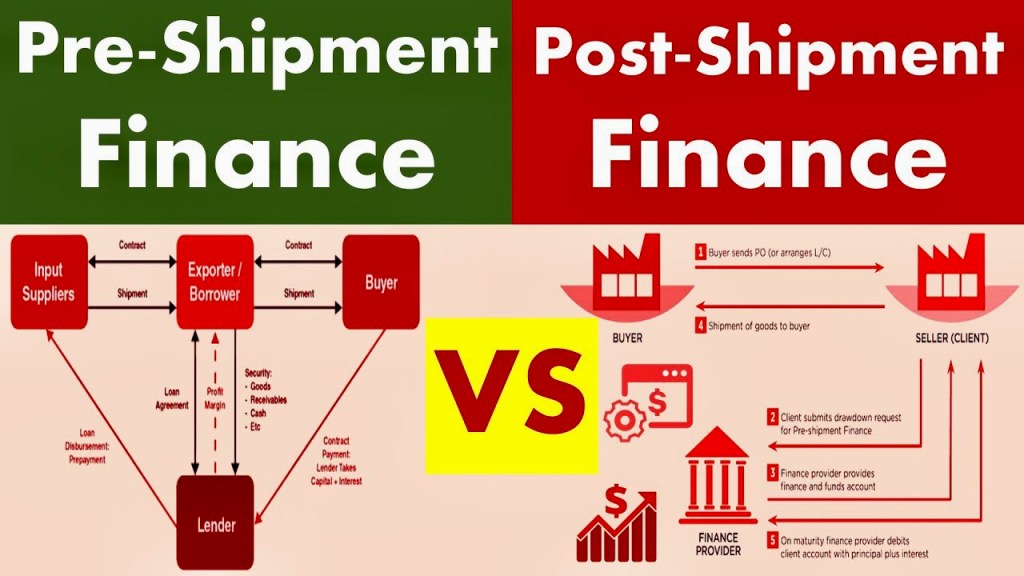

- Pre-shipment Trust Receipt: In a pre-shipment trust receipt, the bank or financial institution releases funds to the borrower before the shipment of goods takes place. This type of trust receipt is typically used to finance the production of goods or to purchase raw materials needed for the manufacturing process.

- Post-shipment Trust Receipt: In a post-shipment trust receipt, the bank or financial institution releases the goods to the borrower before the payment is made. This type of trust receipt is typically used to finance the import of goods that have already been shipped or received by the borrower.

In both cases, the borrower is responsible for the goods until they are fully paid off, and the bank or financial institution retains ownership of the goods until the borrower completes the repayment of the loan. The terms and conditions of the trust receipt, including the repayment schedule, interest rate, and any collateral requirements, are negotiated between the borrower and the bank or financial institution before the trust receipt is issued.